Access the Operator Network

The Associe Collective: An exclusive ecosystem for strategic acquisition and operation of established cash-flowing businesses. Connect with rigorously vetted entrepreneurs and seasoned operators.

Operators Collide Here. Capital Aligns.

We unite visionary operators who reinvest 1.5x more operational income into local communities than conventional buyout funds. Admission prioritizes those advancing long-term value with unwavering integrity.

Lucas Wollschlager

Marketing

Alex White

Product Management

Alexandra Martin

IT Data Governance

Jose Guzman

Financial Services

Brian D’Ambrosio

Enterprise Tech Sales

Michael Emokpae

Business Analytics

Jeremy Jefferson

Veteran

Chris Deitrick

Product Management

Richard Fusco

Operations & Recruiting

Matt Yarborough

Commercial Real Estate

James Souffrant

Business Operations & Growth

Matt Gandy

Startup executive

Connect with Asia's acquisition entrepreneurs, SMB operators, and seasoned advisors in a private membership community.

Navigating Asian acquisitions requires local intelligence — access the Operator Network’s vetted regional partners and regulatory playbooks to accelerate value capture.

The Sovereign Operator Class: Where Equity Meets Execution

Master the Investor-Operator Playbook

Acquire proven frameworks to source, vet, and scale SMB assets with institutional precision.

- Build Acquisition Expertise: Transition from investor to owner through structured entrepreneurship-by-acquisition programs

- Develop Leadership DNA: Accelerate operational competency with battle-tested management workshops

- Command Core Functional: Mastery Access institutional-grade training in financial engineering, talent optimization, and value creation levers

Forge Strategic Capital Alliances

Connect with elite operators and advisory partners to de-risk ownership and accelerate value creation.

- Join the Council of Proven: Operators Access peer syndicates of 100+ portfolio company leaders scaling platform assets

- Leverage On-Demand Expertise: Engage specialized advisors (operational partners/M&A specialists) in closed-door sessions

- Activate Exclusive Capital: Connections Participate in institutional-grade forums: Portfolio optimization workshops • Lender capital markets briefings • Exit planning roundtables

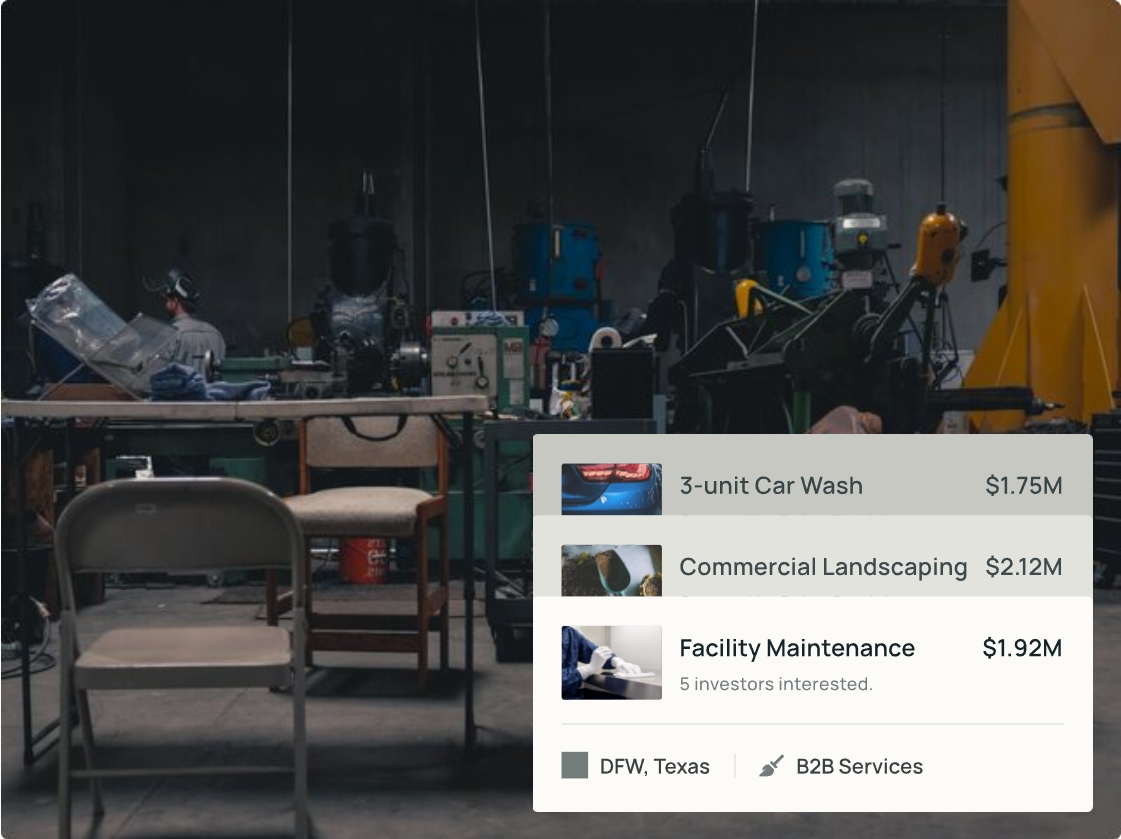

Strategic Business Acquisitions

- Proven Transaction Execution: Partner with seasoned M&A specialists to navigate complex acquisitions. Our team has closed 100+ transactions, delivering precision in due diligence, structuring, and integration.

- Aligned Deal Sourcing: Access curated opportunities matched to your operational expertise, strategic objectives, and investment parameters.

- Capital Solutions: Leverage our network of 500+ accredited investors for streamlined equity syndication and transaction funding.

Supporting the next generation of American Operators is crucial for the future of our great nation. Small businesses are the backbone of our economy, fueling job growth, innovation, and community vitality.

Charles Mullenger SMB Owner Veteran

Mainshares is an incredibly valuable resource and partner for those pursuing a business acquisition. The team has built an unparalleled platform with a wealth of resources.

Matt Yarborough Operator

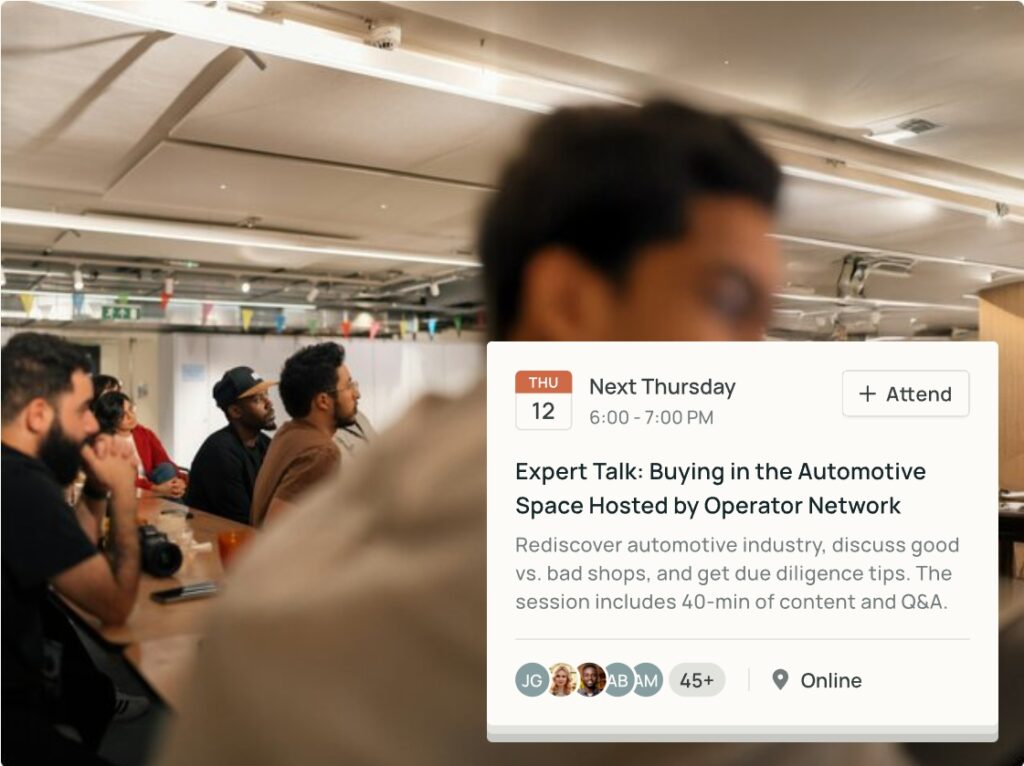

Tactical advice from successful owners

We’ve pulled together the top SMB owner-operators from dozens of industries and across the country. They’re here to ensure the next generation succeeds.

Gary started, operated and sold Annapolis AutoTech

Automotive / Ft. Myers, FL

Patrick owns and operates Blue Ribbon Cooling & Heating

HVAC / Austin, TX

Tom runs one of the top performing Fit Body Bootcamp franchises

Fitness / DFW, TX

Frequently Asked Questions

Complete the form below to start your application. The application takes 2-3 minutes. We try to get back to folks within 2 business days.

Cooperative partner

We're honored to partner with individuals achieving remarkable success

Get the latest insights delivered monthly

Join our SMB newsletter for inspiring stories and practical advice from local owner-operators—working to keep businesses in community hands for the benefit of employees, customers, and neighborhoods alike.

Associe

Website Disclosure: This website (“Website”) is owned and operated by Associe International Ltd. (“Associe”). By accessing this Website, you agree to be bound by Associe’s Terms of Service and Privacy Policy. The information provided herein is strictly for informational purposes and does not constitute investment advice, recommendation, or an offer to sell securities.

Critical Risk Disclosure: Investing in private small and medium enterprise (“SME”) securities involves high speculation and substantial risks, including the potential for complete capital loss. These investments lack secondary market liquidity, have limited operational history and financial data, involve unverified valuations, and carry higher failure rates compared to established businesses. Investors must be prepared to withstand total loss of invested capital.

Investor Commitments: By considering any investment opportunity, you acknowledge the high-risk nature of these investments and commit to conducting independent due diligence, including obtaining additional company information, consulting professional advisors, and verifying regulatory compliance. You confirm that Associe provides no investment recommendations, has not verified issuer-provided information, and assumes no liability for investment decisions.

Individual Investor Requirements: Individual investors must prove Professional Investor status meeting jurisdictional thresholds (e.g., minimum HK$8 million portfolio in Hong Kong), demonstrate “Aggressive” risk tolerance through standardized assessment, and accept binding 36-month lock-up periods. Enhanced due diligence including review of audited financials and management background checks is mandatory.

Jurisdictional Access: Asia-Pacific investors may access opportunities through direct certification (minimum HKD 500,000),SME fund participation(minimum HKD 100,000), or special purpose vehicles (minimum HKD 50,000). United States investors must comply exclusively with Regulation S requirements and are ineligible for retail participation. Mainland China individuals require QDII/QDLP channels with no direct access available.

Regulatory Notice: No securities regulator has approved these offerings or verified content accuracy. All investments are exempt from registration requirements, provide no liquidity guarantees, and may involve material valuation discrepancies.

Our partnership with Associe provides valuable access to capital, advancing our mission at Owners In Honor to help Veterans and Military Spouses confidently transition into small business ownership. This opportunity not only empowers transitioning Veterans but also drives economic growth and fosters lasting community impact.

Patrick Flood Owners in Honor