For Operators

Manage your SMB shareholders

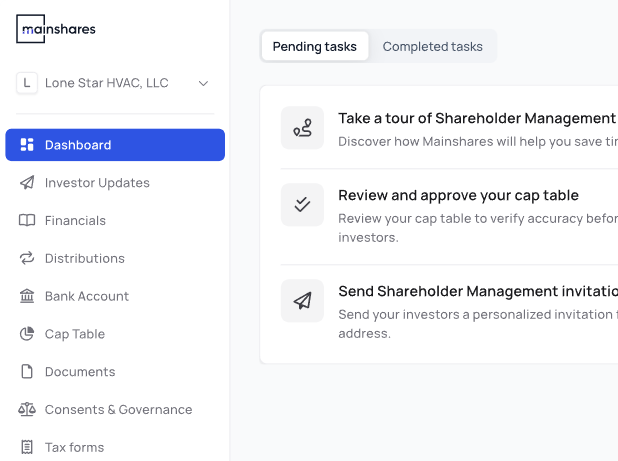

Use Mainshares to centralize your cap table, automate and verify distributions, and send out investor communications — so you can focus on building your business.

Professional-grade experience for you and your shareholders

Lighten your load by streamlining distributions, investor updates, and your cap table — all in one professional-grade platform

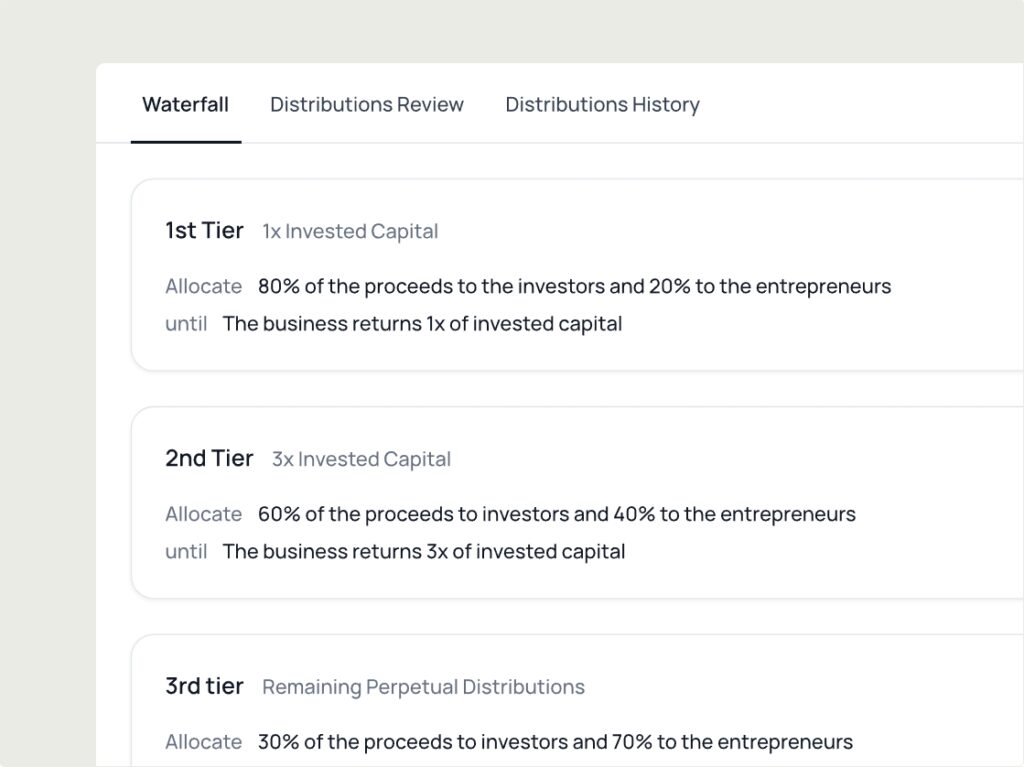

Stay organized with one source of truth for equity ownership & capital returns

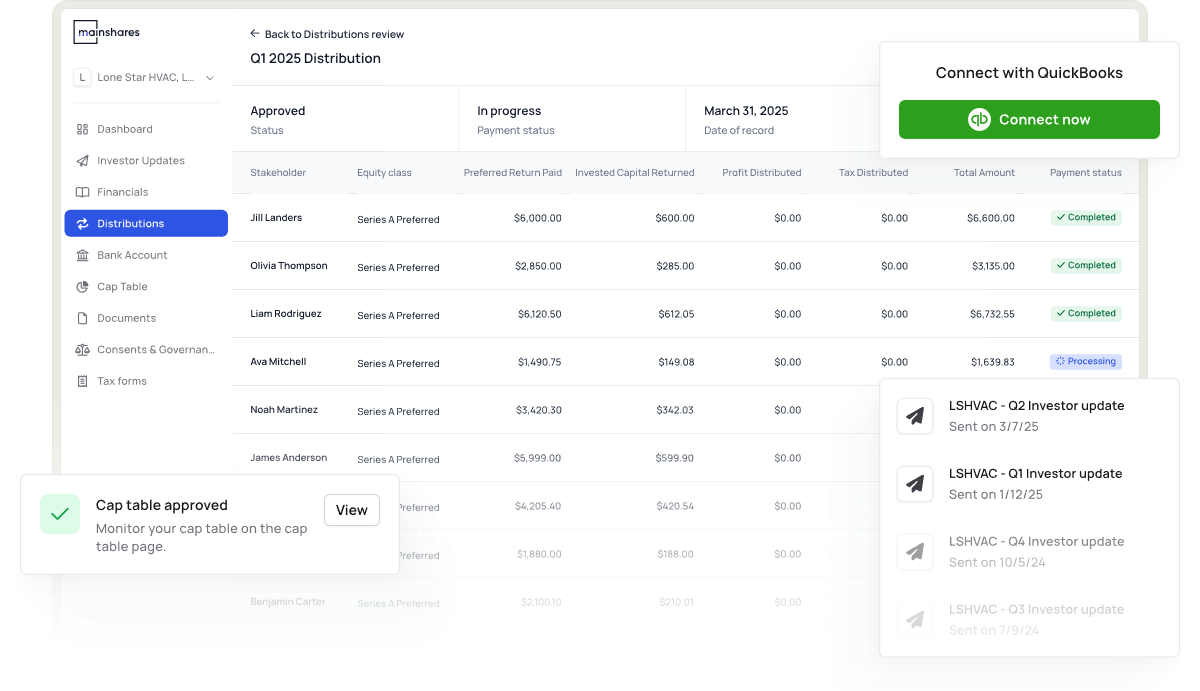

Save time and avoid mistakes with expert support and ACH payments

Earn investor trust with centralized reporting and updates

Accurate and easy to use. Designed to scale with your business.

Mainshares Shareholder Management Platform gives operators the tools, visibility, and support they need to manage investors with confidence and ease.

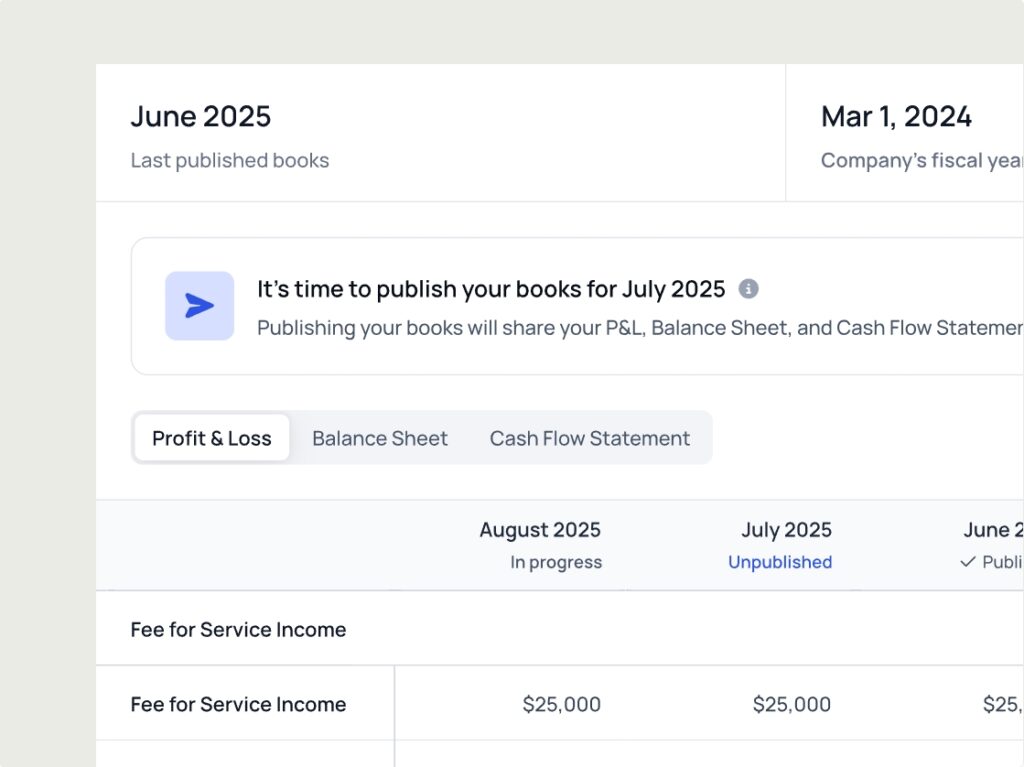

Centralize investor reporting and updates

Reporting Dashboards. Give investors a clear view, cut down on repeat questions.

Send investor distributions with expert support and secure ACH

Build An Equity Source-of-Truth

Cap Table Tracking. Keep ownership and voting power accurate and accessible.

Digital Certificates. Issue and store equity certificates securely on platform.

Return Historicals. Centralize and visualize historical return data, eliminating the need for manual tracking in spreadsheets.

Discover how easy Shareholder Management can be

Check out a quick demo and see how Mainshares takes the pain out of investor ops.

Built for SMB Operators.

Backed by Real Experience.

Their platform not only makes the process easier but adds a level of certainty, professionalism, and access to LPs that is unparalleled.”

Mario Antwine

Owner of Pearl Interactive

“Mainshares has been an incredibly valuable resource and partner for those pursuing a business acquisition.”

Matt Yarborough

Self-funded Searcher

“Mainshares is bringing clarity to the most opaque process for acquisition entrepreneurs: the equity raise.”

Heather Endresen

Viso Business Capital

$285K+

Informed investors can contribute beyond capital— with hiring, intros, & real support

Start for free and get the most out of your cap table

First Year Free

for our Shareholder Management Platform

Streamline operations and elevate the shareholder experience with no hidden fees.

$0 Today

Only $49/month or $499/year after 1 year

Join leading American operators who are transforming how SMB’s are run.

Manage your SMB Shareholders with associe

Get the latest in your inbox

Join our monthly SMB newsletter for stories and insights from those fighting to keep businesses in the hands of local owner-operators—for the benefit of employees, communities, and customers alike.

Associe

Website Disclosure: This website (“Website”) is owned and operated by Associe International Ltd. (“Associe”). By accessing this Website, you agree to be bound by Associe’s Terms of Service and Privacy Policy. The information provided herein is strictly for informational purposes and does not constitute investment advice, recommendation, or an offer to sell securities.

Critical Risk Disclosure: Investing in private small and medium enterprise (“SME”) securities involves high speculation and substantial risks, including the potential for complete capital loss. These investments lack secondary market liquidity, have limited operational history and financial data, involve unverified valuations, and carry higher failure rates compared to established businesses. Investors must be prepared to withstand total loss of invested capital.

Investor Commitments: By considering any investment opportunity, you acknowledge the high-risk nature of these investments and commit to conducting independent due diligence, including obtaining additional company information, consulting professional advisors, and verifying regulatory compliance. You confirm that Associe provides no investment recommendations, has not verified issuer-provided information, and assumes no liability for investment decisions.

Individual Investor Requirements: Individual investors must prove Professional Investor status meeting jurisdictional thresholds (e.g., minimum HK$8 million portfolio in Hong Kong), demonstrate “Aggressive” risk tolerance through standardized assessment, and accept binding 36-month lock-up periods. Enhanced due diligence including review of audited financials and management background checks is mandatory.

Jurisdictional Access: Asia-Pacific investors may access opportunities through direct certification (minimum HKD 500,000),SME fund participation(minimum HKD 100,000), or special purpose vehicles (minimum HKD 50,000). United States investors must comply exclusively with Regulation S requirements and are ineligible for retail participation. Mainland China individuals require QDII/QDLP channels with no direct access available.

Regulatory Notice: No securities regulator has approved these offerings or verified content accuracy. All investments are exempt from registration requirements, provide no liquidity guarantees, and may involve material valuation discrepancies.