For Operators

Achieve SMB ownership with investor-backed capital

Meet the next generation of American owner-operators who raised capital on Mainshares

Joseph successfully closes on Point B Communications

Digital Agency / Chicago, Illinois

Mario raises $1.25M to buy Pearl Interactive Network

Government / Columbus, Ohio

Jacob raised $850K and acquired Floors Galore

Flooring / Jacksonville, North Carolina

Riley Siddoway becomes the owner of Junction Creative

Digital Agency / Marietta, Georgia

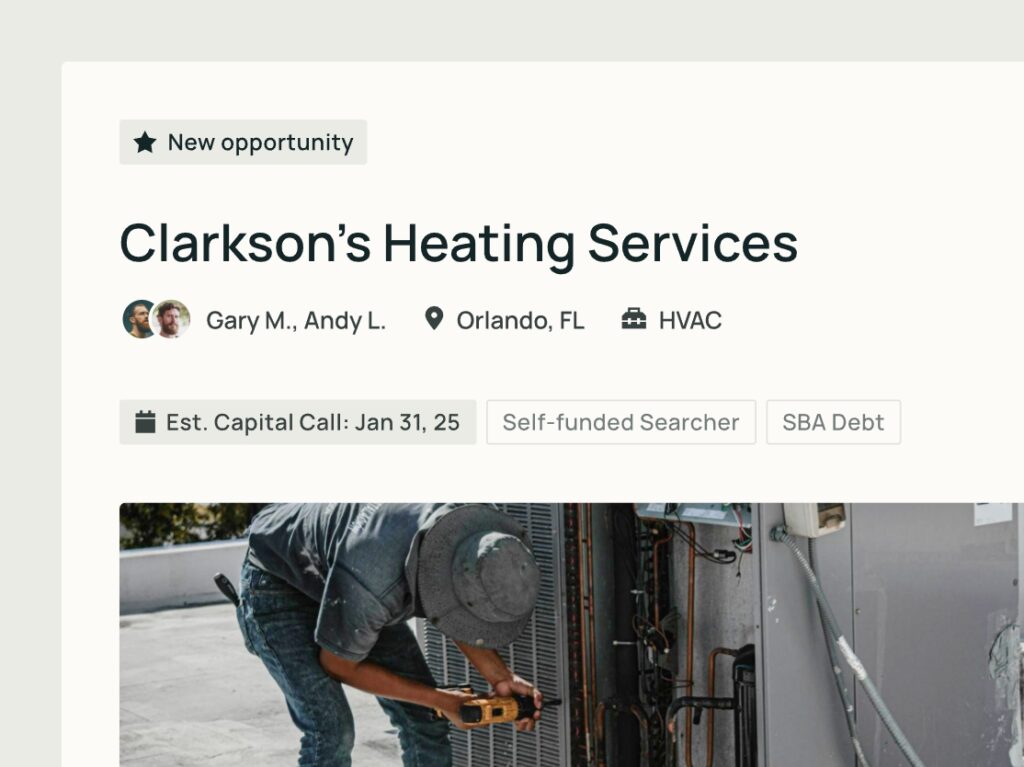

Access Institutional Capital —

Precision-Built for SMBs

Elevate Your Investor Outreach

- Craft Branded Offering Documents: Customize investment materials for consistency and impact

- Distribute Secure Deal Teasers: Share targeted tear sheets with granular privacy controls

- Centralize Due Diligence: Leverage an integrated virtual data room for seamless information sharing

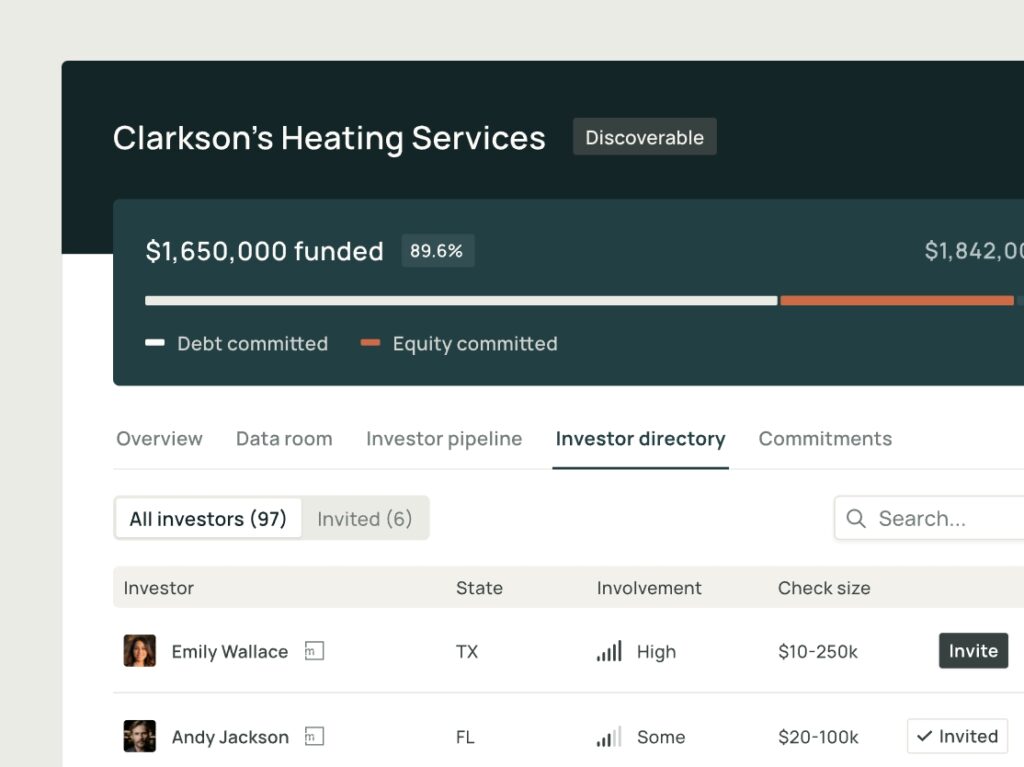

Manage investor access

- Streamlined Investor Onboarding: Utilize secure email invitations and shareable links for efficient access

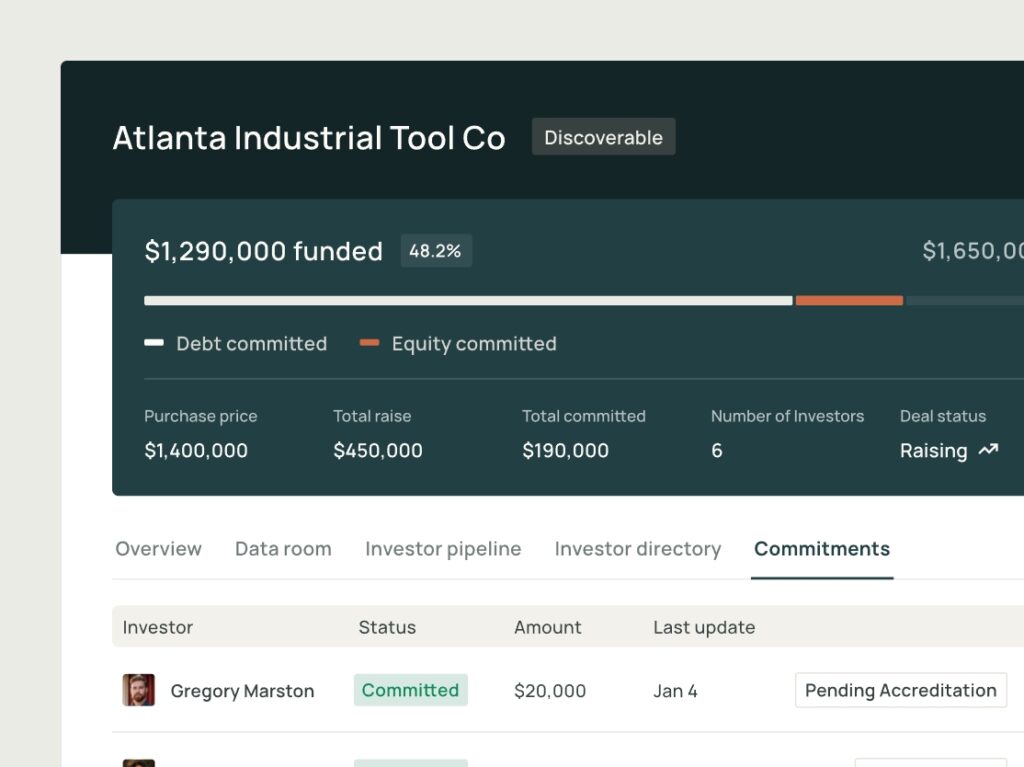

- Centralized Pipeline Management: Track prospects and committed investors through every stage

- Integrated Legal Compliance: Facilitate diligence with embedded, electronically enforceable NDAs

- Targeted Stakeholder Communication: Disseminate professional investor updates and reports

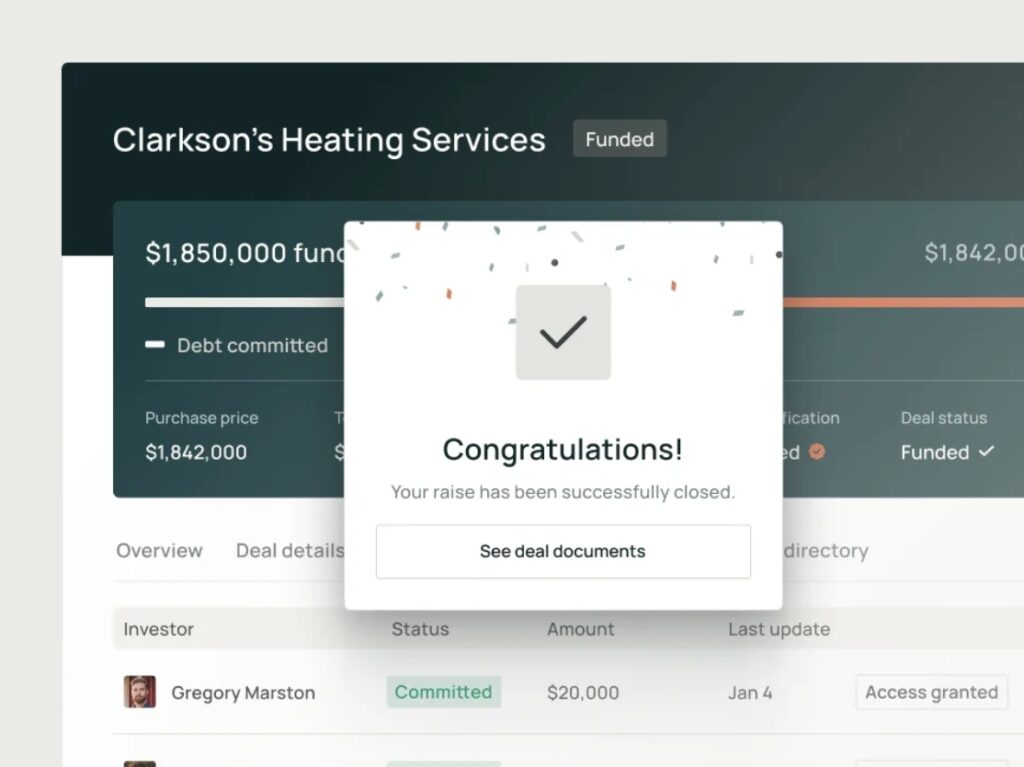

Automate Investor Commitment Workflows

- End-to-End Digital Execution: Enable legally binding e-signatures for commitment agreements

- Integrated Accreditation Screening: Automatically verify investor eligibility per SEC guidelines

- Compliant Onboarding Protocols: Conduct automated KYC/AML checks with audit trails

Optimized Version

- Automated Execution Packages:Digitally compile & e-sign closing docs with AI compliance checks

- Regulatory Escrow Management:Establish MAS/HKMA-compliant accounts with real-time fund tracking

- LP Capital Call Automation:Initiate drawdowns with custom notice periods per APAC timezones

- Smart Filing Solutions:Auto-generate Form D + HK Type 4/SFC filings + Japan FSA notifications

- Investor Transparency Portal:Share audit-ready closing reports via encrypted channels

Access the Mainshares investor network

Entrepreneurs using Mainshares gain access to seasoned SMB investors, family offices and investment

funds focused on SMB deals.

Featured funds

Featured funds

Jeremy Jefferson

Veteran

Chris Deitrick

Product Management

Richard Fusco

Operations & Recruiting

Matt Yarborough

Commercial Real Estate

James Souffrant

Business Operations & Growth

Matt Gandy

Startup executive

Supporting the next generation of American Operators is crucial for the future of our great nation. Small businesses are the backbone of our economy, fueling job growth, innovation, and community vitality.

Charles Mullenger SMB Owner Veteran

Mainshares is an incredibly valuable resource and partner for those pursuing a business acquisition. The team has built an unparalleled platform with a wealth of resources.

Matt Yarborough Operator

Free to start your capital raise

Capital Raise

Entity formations

$349

Accreditation verification

$50 per investor

Digitized commitments

Regulatory Filings

Fees vary per state

Investment Docs

Access to Mainshares Investor Network

Need a Partner to Assist with Fundraising?

Explore working with our affiliated broker-dealer, Main Street Securities.

Due diligence support

Due diligence support

Due diligence support

Cooperative partner

We're honored to partner with individuals achieving remarkable success

Get the latest in your inbox

Join our monthly SMB newsletter for stories and insights from those fighting to keep businesses in the hands of local owner-operators—for the benefit of employees, communities, and customers alike.

Associe

Website Disclosure: This website (“Website”) is owned and operated by Associe International Ltd. (“Associe”). By accessing this Website, you agree to be bound by Associe’s Terms of Service and Privacy Policy. The information provided herein is strictly for informational purposes and does not constitute investment advice, recommendation, or an offer to sell securities.

Critical Risk Disclosure: Investing in private small and medium enterprise (“SME”) securities involves high speculation and substantial risks, including the potential for complete capital loss. These investments lack secondary market liquidity, have limited operational history and financial data, involve unverified valuations, and carry higher failure rates compared to established businesses. Investors must be prepared to withstand total loss of invested capital.

Investor Commitments: By considering any investment opportunity, you acknowledge the high-risk nature of these investments and commit to conducting independent due diligence, including obtaining additional company information, consulting professional advisors, and verifying regulatory compliance. You confirm that Associe provides no investment recommendations, has not verified issuer-provided information, and assumes no liability for investment decisions.

Individual Investor Requirements: Individual investors must prove Professional Investor status meeting jurisdictional thresholds (e.g., minimum HK$8 million portfolio in Hong Kong), demonstrate “Aggressive” risk tolerance through standardized assessment, and accept binding 36-month lock-up periods. Enhanced due diligence including review of audited financials and management background checks is mandatory.

Jurisdictional Access: Asia-Pacific investors may access opportunities through direct certification (minimum HKD 500,000),SME fund participation(minimum HKD 100,000), or special purpose vehicles (minimum HKD 50,000). United States investors must comply exclusively with Regulation S requirements and are ineligible for retail participation. Mainland China individuals require QDII/QDLP channels with no direct access available.

Regulatory Notice: No securities regulator has approved these offerings or verified content accuracy. All investments are exempt from registration requirements, provide no liquidity guarantees, and may involve material valuation discrepancies.

Our partnership with Associe provides valuable access to capital, advancing our mission at Owners In Honor to help Veterans and Military Spouses confidently transition into small business ownership. This opportunity not only empowers transitioning Veterans but also drives economic growth and fosters lasting community impact.

Patrick Flood Owners in Honor