For Investors

Power Progress, Grow Wealth: Strategic SMB Investing in Asia

Beyond the Age Wave: Co-Designing Our Demographic Future

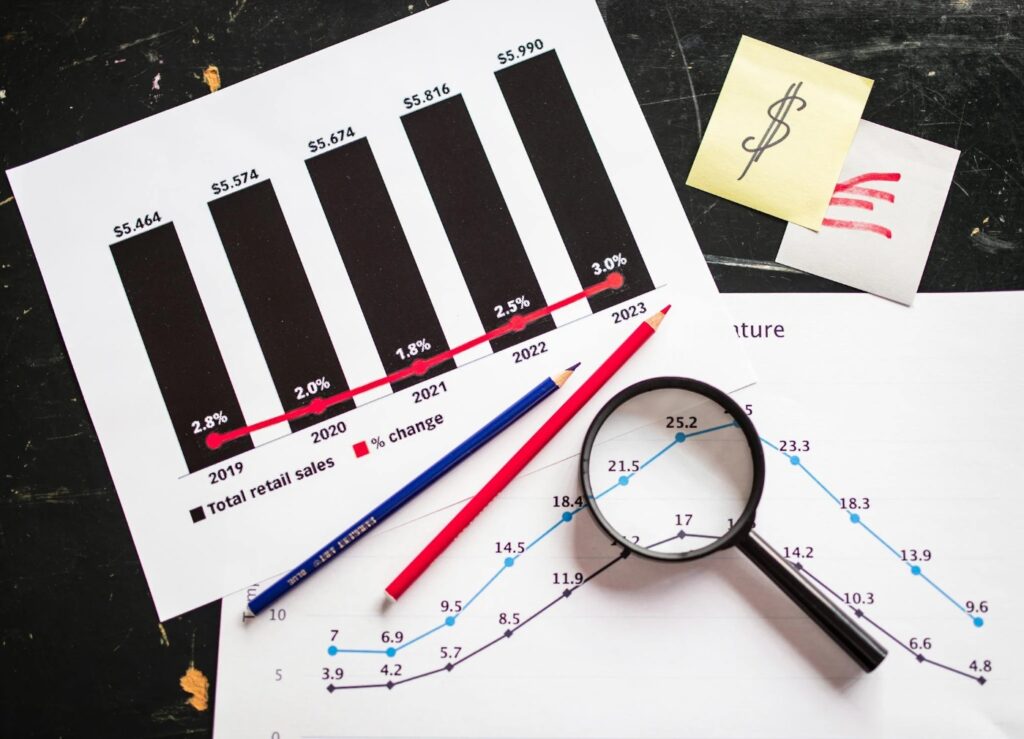

Asia's 47M+ SMEs—including China's 43M (90%+ enterprises) and Hong Kong's 360K (98% local businesses) —power 35-45% of regional GDP and employ 65-80% of workers. Facing a trillion-dollar generational transition, they drive innovation yet grapple with financing gaps. Strategic policy integration is unlocking their global value chain potential.

SMEs

Workers

Generational transition

What will happen to those businesses?

At Associe, we forge alliances where owner-operators, investors, and industry leaders converge. Together, we transform Asia’s small businesses—70% at risk of vanishing by the third generation—into resilient, community-anchored institutions. Our partnership model delivers tri-dimensional empowerment: capital-fueled growth, knowledge transfer, and network synergy.

For enterprises, this means preserving cultural DNA while scaling capabilities; for partners, it unlocks sustainable returns and ecosystem influence. We turn isolated ventures into interlinked pillars of prosperity.

Co-Invest | Co-Innovate | Co-Grow: The Associe Capital Partnership

Our network unites entrepreneurs-turned-investors, commercial real estate innovators, and strategic family offices – all committed to fueling Asia’s SMB renaissance. With 50+ new accredited investors joining monthly, we are building the region’s most agile capital collective for small-business growth.

Judd Nutting

🇺🇸 Longmont, CO

Adam Broussard

🇺🇸 New Orleans, LA

Chris Munn

🇺🇸 Orlando, FL

Michael Dworkis

🇺🇸 McLean, VA

Stephen Hagerman

🇺🇸 Austin, TX

Sean Smith

🇺🇸 Chicago, IL

Unlocking Alpha: Why SMBs Deliver Outsized Impact

Unlock Next-Generation Portfolio Resilience

Engineer Predictable Passive Income Streams

Capture Amplified Returns Through Strategic Leverage

Benefit from unique market dynamics: Asian SMBs represent a valuation opportunity, often acquired at significantly lower multiples (3-6x EBITDA) than mid-market peers (10-15x+). Combined with high levels of SBA-backed financing (60-90%), these mechanics create substantial potential for equity appreciation at exit.

Fuel Local Economies & Trusted Communities

New deals every week

Mainshares is the leading small business investing platform

We unite visionary operators who reinvest 1.5x more operational income into local communities than conventional buyout funds. Admission prioritizes those advancing long-term value with unwavering integrity.

Associe

Website Disclosure: This website (“Website”) is owned and operated by Associe International Ltd. (“Associe”). By accessing this Website, you agree to be bound by Associe’s Terms of Service and Privacy Policy. The information provided herein is strictly for informational purposes and does not constitute investment advice, recommendation, or an offer to sell securities.

Critical Risk Disclosure: Investing in private small and medium enterprise (“SME”) securities involves high speculation and substantial risks, including the potential for complete capital loss. These investments lack secondary market liquidity, have limited operational history and financial data, involve unverified valuations, and carry higher failure rates compared to established businesses. Investors must be prepared to withstand total loss of invested capital.

Investor Commitments: By considering any investment opportunity, you acknowledge the high-risk nature of these investments and commit to conducting independent due diligence, including obtaining additional company information, consulting professional advisors, and verifying regulatory compliance. You confirm that Associe provides no investment recommendations, has not verified issuer-provided information, and assumes no liability for investment decisions.

Individual Investor Requirements: Individual investors must prove Professional Investor status meeting jurisdictional thresholds (e.g., minimum HK$8 million portfolio in Hong Kong), demonstrate “Aggressive” risk tolerance through standardized assessment, and accept binding 36-month lock-up periods. Enhanced due diligence including review of audited financials and management background checks is mandatory.

Jurisdictional Access: Asia-Pacific investors may access opportunities through direct certification (minimum HKD 500,000),SME fund participation(minimum HKD 100,000), or special purpose vehicles (minimum HKD 50,000). United States investors must comply exclusively with Regulation S requirements and are ineligible for retail participation. Mainland China individuals require QDII/QDLP channels with no direct access available.

Regulatory Notice: No securities regulator has approved these offerings or verified content accuracy. All investments are exempt from registration requirements, provide no liquidity guarantees, and may involve material valuation discrepancies.